Introduction:

In the complex landscape of healthcare, having a comprehensive understanding of health insurance is crucial for individuals and families to navigate the system effectively. A well-informed approach to healthcare can lead to better outcomes, financial security, and an overall sense of well-being. This article aims to provide a roadmap to wellness, emphasizing the importance of insurance wisdom in the journey to optimal health.

Section 1: Understanding Health Insurance Basics

1.1 What is Health Insurance? Health insurance is a financial tool designed to cover the costs of medical and surgical expenses. It acts as a safeguard, protecting individuals from the potentially high costs associated with healthcare services.

1.2 Types of Health Insurance Plans Explore the various types of health insurance plans, including HMOs, PPOs, and high-deductible health plans. Understanding the differences between these plans is essential in selecting one that aligns with individual healthcare needs and preferences.

1.3 Key Insurance Terminology Demystify insurance jargon by explaining key terms such as premiums, deductibles, copayments, and coinsurance. Knowing these terms empowers individuals to make informed decisions about their healthcare coverage.

Section 2: Choosing the Right Health Insurance Plan

2.1 Assessing Individual Healthcare Needs Examine the factors that influence the choice of a health insurance plan, including personal health history, family needs, and financial considerations. Tailoring coverage to specific requirements ensures comprehensive protection.

2.2 Network Considerations Understanding healthcare provider networks is crucial. Evaluate the differences between in-network and out-of-network care, and how these choices can impact both cost and accessibility of healthcare services.

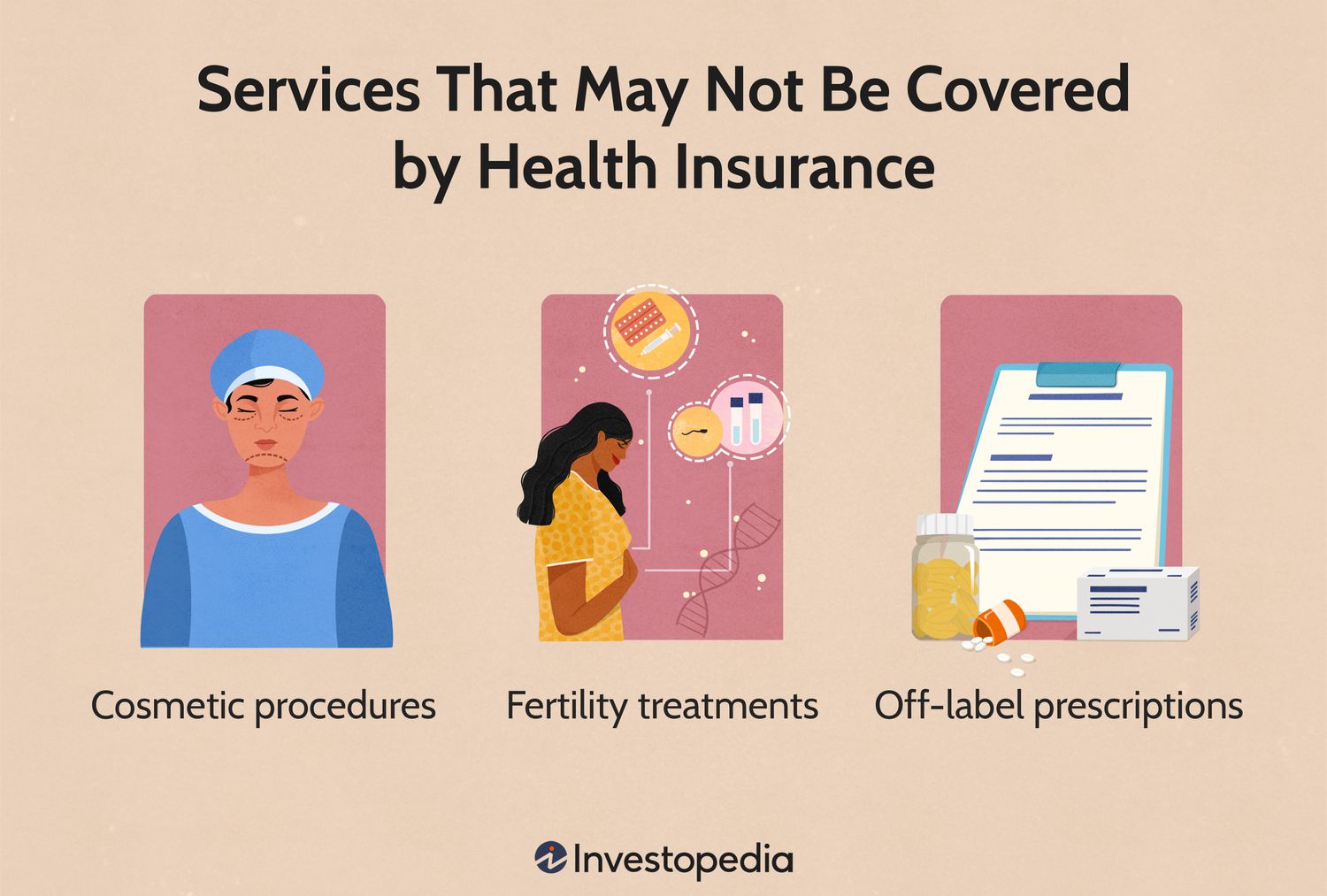

2.3 Prescription Drug Coverage Analyze prescription drug coverage options within insurance plans. Consider factors such as formularies, tiered pricing, and mail-order pharmacy services to ensure adequate coverage for necessary medications.

Section 3: Maximizing Health Insurance Benefits

3.1 Preventive Care and Wellness Programs Explore the role of preventive care in maintaining optimal health. Learn how health insurance often covers preventive services at no additional cost and discover wellness programs that can contribute to overall well-being.

3.2 Utilizing Telehealth Services In the digital age, telehealth services play a significant role in healthcare accessibility. Understand how health insurance plans often include telehealth options, providing convenient and cost-effective alternatives to traditional office visits.

3.3 Emergency and Urgent Care Delve into the specifics of emergency and urgent care coverage. Know when to seek each type of care, and how insurance plans address these situations to ensure timely and appropriate medical attention.

Section 4: Financial Planning and Health Savings Accounts (HSAs)

4.1 Budgeting for Healthcare Costs Develop a comprehensive understanding of potential out-of-pocket expenses, including copays, deductibles, and coinsurance. Learn how to budget effectively to manage healthcare costs within the context of overall financial planning.

4.2 Exploring Health Savings Accounts (HSAs) Discover the benefits of Health Savings Accounts (HSAs) as a tool for managing healthcare expenses. Explore how these accounts offer tax advantages and can serve as a valuable component of a long-term financial strategy.

Section 5: Navigating the Claims Process

5.1 Submitting Insurance Claims Gain insights into the insurance claims process. Understand how to submit claims accurately and efficiently, ensuring timely reimbursement for covered medical expenses.

5.2 Appealing Insurance Denials In the event of a claim denial, learn the steps to appeal the decision. Understanding the appeals process can be crucial in ensuring that legitimate claims are reconsidered and approved.

Conclusion:

A proactive and informed approach to health insurance is key to achieving a roadmap to wellness. By understanding the basics, choosing the right plan, maximizing benefits, and navigating the financial aspects effectively, individuals can not only secure their health but also contribute to their overall sense of security and well-being. Armed with insurance wisdom, the journey towards optimal health becomes a well-guided and empowered endeavor.