Contents

- 1 Table of Contents

- 2

- 3 Understanding the Basics of Health Insurance

- 4 Protection Against Unexpected Medical Expenses

- 5 Safeguarding Your Savings and Assets

- 6 Access to Quality Healthcare

- 7 Peace of Mind for Your Loved Ones

- 8 Legal Requirements and Penalties

- 9 Types of Health Insurance Plans

- 10 Choosing the Right Health Insurance

- 11 Coverage Options and Add-Ons

- 12 Common Health Insurance Terms to Know

- 13 Health Insurance and Preventive Care

- 14 Health Insurance in Times of Crisis

- 15 Health Insurance for the Self-Employed

- 16 How to Make the Most of Your Health Insurance

- 17 The Future of Health Insurance

- 18 FAQs

Table of Contents

- Understanding the Basics of Health Insurance

- Protection Against Unexpected Medical Expenses

- Safeguarding Your Savings and Assets

- Access to Quality Healthcare

- Peace of Mind for Your Loved Ones

- Legal Requirements and Penalties

- Types of Health Insurance Plans

- Choosing the Right Health Insurance

- Coverage Options and Add-Ons

- Common Health Insurance Terms to Know

- Health Insurance and Preventive Care

- Health Insurance in Times of Crisis

- Health Insurance for the Self-Employed

- How to Make the Most of Your Health Insurance

- The Future of Health Insurance

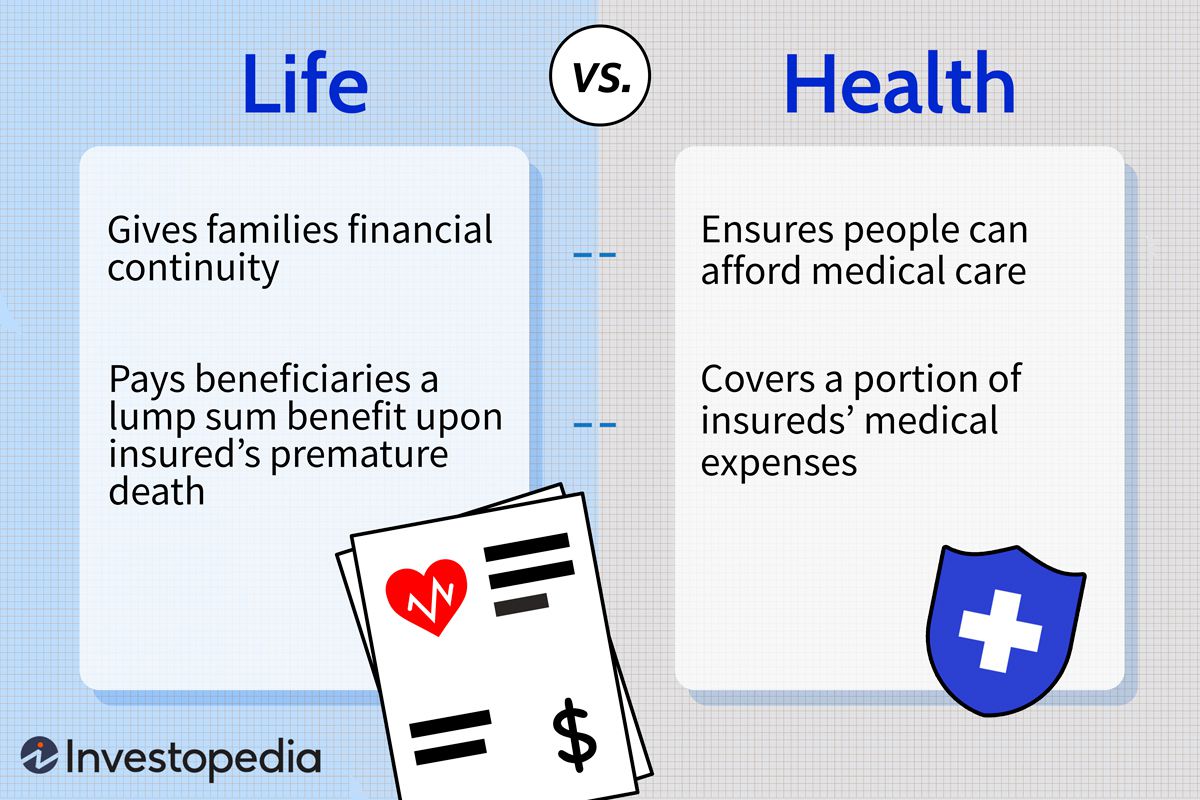

Understanding the Basics of Health Insurance

Health insurance is a contract between an individual and an insurance company, where the insurer agrees to cover a portion of the individual’s healthcare expenses in exchange for regular premium payments. This coverage typically extends to a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care.

Protection Against Unexpected Medical Expenses

One of the primary reasons to have health insurance is to shield yourself from the financial shock of unexpected medical bills. Without insurance, a sudden illness or injury can lead to substantial out-of-pocket expenses, potentially draining your savings or pushing you into debt.

Safeguarding Your Savings and Assets

Health insurance acts as a financial safety net, preserving your hard-earned money and assets. With the right coverage, you can avoid dipping into your savings or selling valuable assets to cover medical costs, ensuring your financial stability.

Access to Quality Healthcare

Having health insurance often means having access to a network of healthcare providers and specialists. This access ensures that you receive quality care when you need it, without worrying about the cost.

Peace of Mind for Your Loved Ones

Health insurance doesn’t just benefit you; it also provides peace of mind to your family. Knowing that you are financially protected in case of a health crisis can alleviate stress and allow you to focus on your recovery.

Legal Requirements and Penalties

In some countries, having health insurance is a legal requirement. Failing to obtain coverage can result in penalties or fines. Understanding the legal implications in your area is essential to avoid such consequences.

Types of Health Insurance Plans

There are various types of health insurance plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High-Deductible Health Plans (HDHPs). Each has its advantages and disadvantages, making it crucial to choose the right plan for your needs.

Choosing the Right Health Insurance

Selecting the right health insurance plan involves considering factors such as your budget, healthcare needs, and preferred doctors and hospitals. It’s essential to compare different plans and choose one that aligns with your requirements.

Coverage Options and Add-Ons

Health insurance plans often offer additional coverage options, such as dental, vision, and mental health coverage. Evaluating these options and customizing your plan can enhance your overall healthcare experience.

Common Health Insurance Terms to Know

Understanding health insurance terminology can be challenging. Familiarize yourself with terms like premiums, deductibles, copayments, and out-of-pocket maximums to make informed decisions.

Health Insurance and Preventive Care

Many health insurance plans cover preventive services like vaccinations and screenings at no additional cost. Investing in preventative care can save you money in the long run by avoiding more significant health issues.

Health Insurance in Times of Crisis

Health insurance proves its worth during unexpected crises, such as a severe illness or a global pandemic. It ensures that you receive the necessary medical care without worrying about the financial burden.

Health Insurance for the Self-Employed

Self-employed individuals often lack the benefit of employer-sponsored health insurance. Finding the right health insurance plan is vital for freelancers and entrepreneurs to secure their health and finances.

How to Make the Most of Your Health Insurance

To maximize your health insurance benefits, stay informed about your coverage, utilize in-network providers, and take advantage of wellness programs and discounts offered by your insurer.

The Future of Health Insurance

As healthcare evolves, so does health insurance. Emerging trends include telemedicine, personalized health plans, and greater transparency in pricing. Staying abreast of these changes can help you make more informed decisions regarding your coverage.

In conclusion, health insurance is not just an expense; it’s an investment in your financial security and peace of mind. It protects you from unexpected medical bills, safeguards your assets, and ensures access to quality healthcare. Whether you’re self-employed or part of a family, choosing the right health insurance plan is a critical step toward securing your future.

FAQs

- Why is health insurance important?

- Health insurance is vital because it protects you from unexpected medical expenses and provides access to quality healthcare, ensuring your financial security and peace of mind.

- How do I choose the right health insurance plan?

- To choose the right plan, consider your budget, healthcare needs, and preferred doctors. Compare different plans and customize them to align with your requirements.

- Can I get fined for not having health insurance?

- In some countries, not having health insurance can result in fines or penalties. It’s essential to understand the legal requirements in your area.

- What is preventive care, and why is it essential?

- Preventive care includes vaccinations and screenings that can help you avoid more significant health issues. Many health insurance plans cover preventive services at no additional cost.

- What does the future of health insurance look like?

- The future of health insurance includes trends like telemedicine, personalized health plans, and greater price transparency, all aimed at providing more accessible and efficient healthcare.